Anti Money Laundering Regulations For Letting Agents

The concept of cash laundering is very important to be understood for those working within the financial sector. It is a process by which dirty money is converted into clear money. The sources of the cash in precise are criminal and the cash is invested in a method that makes it look like clear cash and conceal the id of the legal a part of the money earned.

Whereas executing the monetary transactions and establishing relationship with the brand new prospects or sustaining existing prospects the responsibility of adopting enough measures lie on each one who is part of the group. The identification of such component to start with is easy to deal with as an alternative realizing and encountering such conditions in a while within the transaction stage. The central bank in any nation gives complete guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously provide enough safety to the banks to deter such conditions.

AML rules which have traditionally applied only for sales agents are designed to crack down on the use of the financial system and in this case specifically property purchases for funding of criminal activities via money laundering. Register for Anti-Money Laundering.

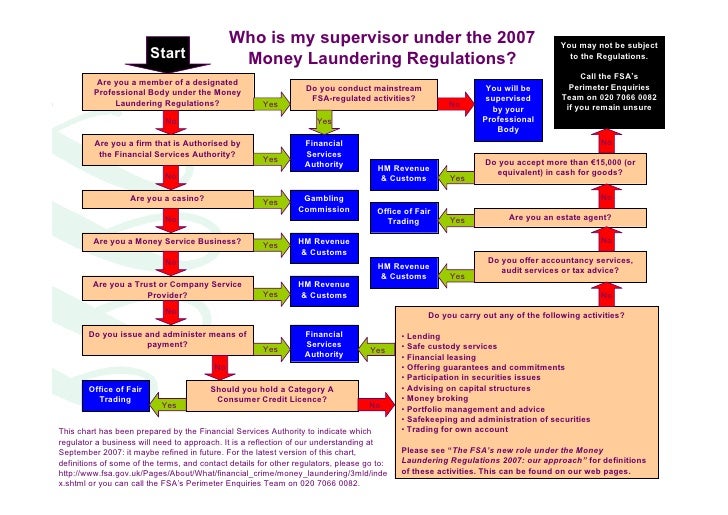

Anti Money Laundering In The Uk Who Regulates Me

Anti-Money Laundering Letting Agents From 10 January 2020 all letting agents who manage properties which individually yield an income of 10000 Euros per month or equivalent or more must now comply with regulations set out in the Fifth Money Laundering Directive.

Anti money laundering regulations for letting agents. Letting agencies are not regulated and so none of the obligations apply and this has always been the. The Estate Agency Client Identification and Risk Assessment Form is for use by an Estate Agent when checking the identity of a new client for Anti-Money Laundering purposes. The form can also be used to verify the other contracting party andor any beneficial owners.

As a result letting agents are now supervised by HMRC for anti-money laundering and counter-terrorist financing AMLCTF purposes if they rent out residential or commercial property for one. Updated Money Laundering Risk Assessments for Estate Agents and Letting Agents. New anti-money laundering laws Money Laundering and Terrorist Financing Amendment Regulations 2019 come into force tomorrow.

These measures are found in the Money Laundering and Terrorist Financing Amendment Regulations 2019 the Regulations. If You Are Already Registered as for Sales. Estate agency businesses are regulated by the Money Laundering Regulations of 2017 and as such there are numerous statutory obligations estate agents must comply with.

New anti-money laundering rules for letting agencies from January 2020 Em Morley - December 6 2019 Changes to Anti-Money Laundering AML rules should not be overlooked despite everyones main focus currently being the upcoming General Election. These range from registering with HMRC through to conducting customer due diligence steps on sellers and buyers. Anti-Money Laundering Regulations for Landlords In the UK Estate Agents are already required to demonstrate that they know their customer and apply Anti-Money Laundering measures and demonstrate due diligence with all new and continuing customers.

An estate agency or letting agency business may be regulated by the Financial Conduct Authority FCA for another purpose for example because they provide consumer finance or. They also come into play whenever agents renew tenancies that existed before that date. Since January 2019 letting agents have been required to comply with anti-money laundering AML legislation for the first time.

Letting agents who deal in a rental property residential or commercial with a monthly rent of or equivalent to EUR 10000 or above are required to carry out customer due diligence CDD checks and comply with other anti-money laundering requirements. The Fifth Money Laundering Directive came into force in the UK on January 10 2020. From this date all letting agents who manage any properties with an individual rental yield of 10000 Euros a month approx 871845 as of time of writing must comply with the regulations.

The regulations have also been expanded to include the letting agency sector for high-value transactions with a monthly rent of 10000 euros. Those letting agents who fall within the scope of regulated businesses and manage tenancies that meet the threshold will need to register for anti-money laundering AML supervision. The new rules for lettings agents.

All letting agents across the UK are now supervised by HMRC for anti-money laundering AML and counter-terrorist financing purposes if they meet this requirement and must register with HMRC by 10 January 2021. CDD checks need to be carried out on any new tenants and landlords from 10 January 2020. The anti-money laundering regulations for letting agents apply to all new tenancies that began following 10th January 2020.

But what in reality will be the impact on sales and lettings agents. A link to Money laundering. 17 July 2020 Updated to remove letting agency.

As of 10 th January this year any UK letting agent managing properties residential or commercial that yield an income of 10000 Euros or more per month must comply with updated money laundering regulations under the Fifth Money Laundering Directive Agents handling these higher value rentals must now. On 10 th January 2020 new AML rules will be put in place. Understanding risks and taking action for estate agency and letting agency businesses has been added.

We have waited 18 months for them and during that time there has been plenty of speculation about what they would contain.

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data

Pdf Anti Money Laundering Regulation And The Art Market

The 5th Money Laundering Directive Is Here

New Fifth Money Laundering Directive Rules Come Into Force

Revised Central Bank Amla Guidelines Anti Money Laundering

Anti Money Laundering Course Aml Training Courses Certification Virtual College

What Is Anti Money Laundering Aml Money Laundering Financial Literacy Money

Anti Money Laundering Regulations What Is Expected Of You As A Property Sourcer Professional Sourcing Compliance

Pdf Anti Money Laundering Aml Regulation And Implementation In Chin Mirzosharif Sharipov Academia Edu

Anti Money Laundering Implications

Alphabet City S Money Laundering Policy By Alphabet City Estate Agents Issuu

Anti Money Laundering Ultimate Guide Training Express

The world of laws can look like a bowl of alphabet soup at occasions. US cash laundering regulations are not any exception. We've got compiled a list of the highest ten cash laundering acronyms and their definitions. TMP Threat is consulting agency focused on protecting monetary providers by lowering risk, fraud and losses. Now we have big bank experience in operational and regulatory threat. We have a powerful background in program administration, regulatory and operational risk in addition to Lean Six Sigma and Business Course of Outsourcing.

Thus cash laundering brings many opposed penalties to the organization because of the risks it presents. It will increase the probability of main dangers and the opportunity cost of the bank and finally causes the bank to face losses.

Comments

Post a Comment