Stages Of Money Laundering Definition

The idea of money laundering is essential to be understood for these working within the financial sector. It's a process by which soiled cash is converted into clean money. The sources of the money in precise are felony and the cash is invested in a way that makes it appear like clear cash and conceal the id of the felony a part of the money earned.

While executing the financial transactions and establishing relationship with the brand new customers or maintaining present customers the duty of adopting enough measures lie on each one who is a part of the organization. The identification of such component at first is easy to cope with as an alternative realizing and encountering such situations in a while in the transaction stage. The central financial institution in any country provides full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present sufficient security to the banks to deter such conditions.

As the process of money laundering has become the centre of attention money laundering cases have been analyzed seriously thoroughly and systematically. What are the Three Stages of Money Laundering.

Understanding Money Laundering European Institute Of Management And Finance

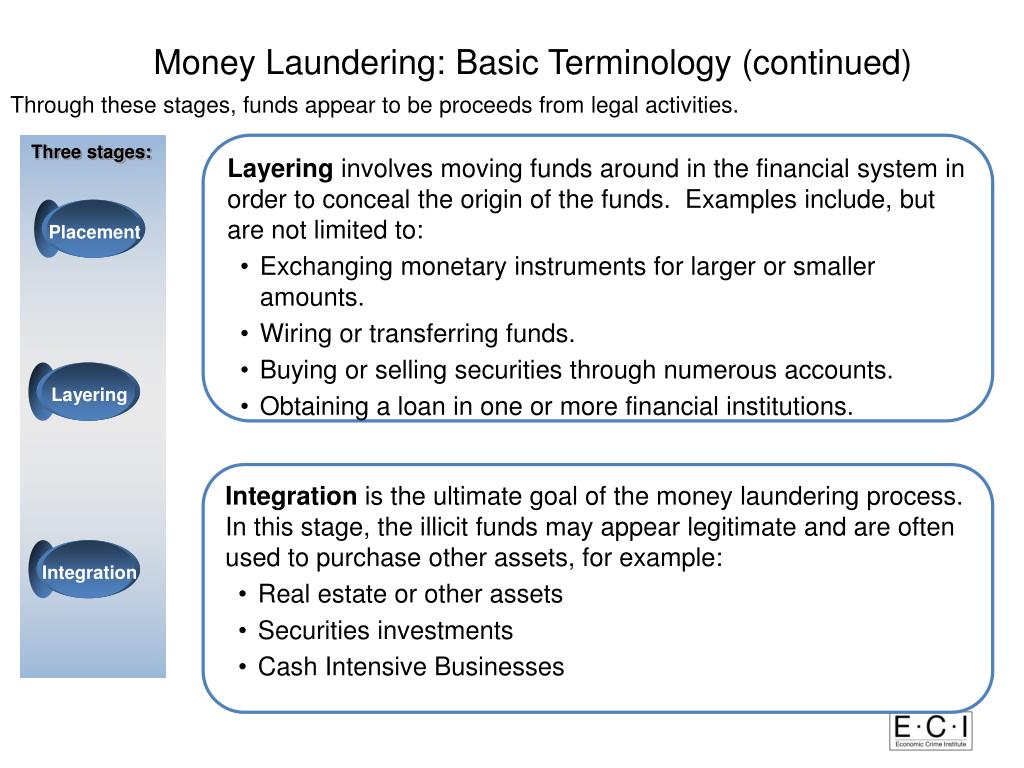

Although the specific techniques used to clean dirty money vary financial experts cite three stages of money laundering in the process.

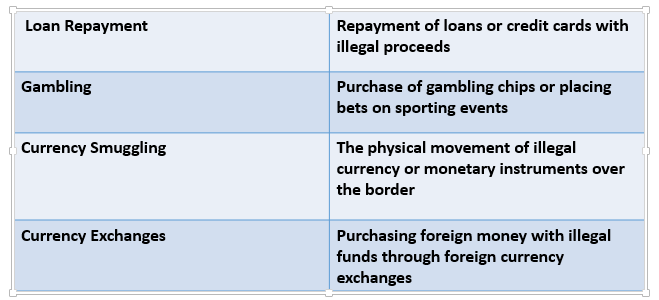

Stages of money laundering definition. Placement layering and integration. Money laundering is a process which typically follows three stages to finally release laundered funds into the legal financial system. How Money Laundering Works Money laundering typically occurs in three phases.

The money laundering process most commonly occurs in three key stages. This lesson explores the three stages of money laundering and gives. The Placement Stage Filtering.

Disguising the trail to foil pursuit. Money laundering is a process of three stages placement stage layering stage and integration stage which may occur simultaneously or stage by stage or they may overlap. Stages of Money Laundering Placement.

In this stage money comes back to owner or criminal from the sources appearing to be legitimate and is integrated into the financial system. Money laundering a process uses by offenders who attempt to conceal the true origin and ownership of the proceeds. The first stage of money laundering placement requires the placement of criminally-derived proceeds in the financial system.

In the initial - or placement - stage of money laundering the launderer introduces his illegal profits into the financial system. There are three stages involved in money laundering. The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system.

Placement layering and integration. The stages of money laundering include the. 1 placement 2 layering and 3 integration.

In the first stage the money launderer injects the proceeds of criminal activity to the financial system. The final stage in money laundering cycle is INTEGRATION. Each individual money laundering stage can be extremely complex due to the criminal activity involved.

A it relieves the criminal of holding and guarding large amounts of bulky of cash. Initial entry or placement is the initial movement of an amount of money earned from criminal activity into some legitimate financial network or institution. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial.

The money laundering process is divided into 3 segments. Money Laundering Placement Layering Integration three stages. Definition and Stages.

Money laundering is the process of concealing or destroying the paper trail associated with money obtained through illicit means. Generally this stage serves two purposes. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system.

Stage 1 of Money Laundering. 3 Stages of Money Laundering Placement ie. These proceeds are results of criminal activities.

Moving the funds from direct association with the crime Layering ie. And b it places the money into the legitimate financial. The money appears to be from normal business or trade earnings.

And this is done by dividing the large sum of money into smaller amounts and deposited into bank accounts or by buying financial instruments which are collected later on and deposited into bank accounts.

3 Stages Of Money Laundering Techniques Anti Money Laundering

Guide To Money Laundering In The Year 2020 Money Laundering Financial Institutions The Year 2020

What Are The Stages Of Money Laundering Process The Money Laundering Cycle Can Be Broken Down Into Three Distinct Stages

What Is Anti Money Laundering Aml Anti Money Laundering

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

What Is Money Laundering Three Methods Or Stages In Money Laundering

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

What Are The Three Stages Of The Money Laundering Process The Best Time To Stop Money Laundering Is At The Placement Stage

Process Of Money Laundering Placement Layering Integration

Process Of Money Laundering Placement Layering Integration

Understanding The Risks Of Money Laundering In Sri Lanka The Lakshman Kadirgamar Institute

Pin On Prodefence Security News

What Is Money Laundering Three Methods Or Stages In Money Laundering

The world of rules can appear to be a bowl of alphabet soup at instances. US money laundering regulations aren't any exception. We now have compiled a list of the highest ten money laundering acronyms and their definitions. TMP Threat is consulting firm centered on defending monetary companies by lowering threat, fraud and losses. Now we have massive bank experience in operational and regulatory threat. Now we have a strong background in program administration, regulatory and operational danger as well as Lean Six Sigma and Business Process Outsourcing.

Thus cash laundering brings many hostile penalties to the organization because of the dangers it presents. It increases the probability of major dangers and the opportunity price of the financial institution and in the end causes the financial institution to face losses.

Comments

Post a Comment